American Express has just refreshed the offers available on its duo of premium Aeroplan co-branded credit cards – the American Express Aeroplan Reserve Card and the American Express Aeroplan Business Reserve Card – with up to 85,000 and 95,000 Aeroplan points up for grabs, respectively.

These two cards are great options for Air Canada frequent flyers, as they come with a host of added perks.

Read on to check out the best-available offers on the American Express Aeroplan co-branded credit cards, which don’t come with a listed expiry date.

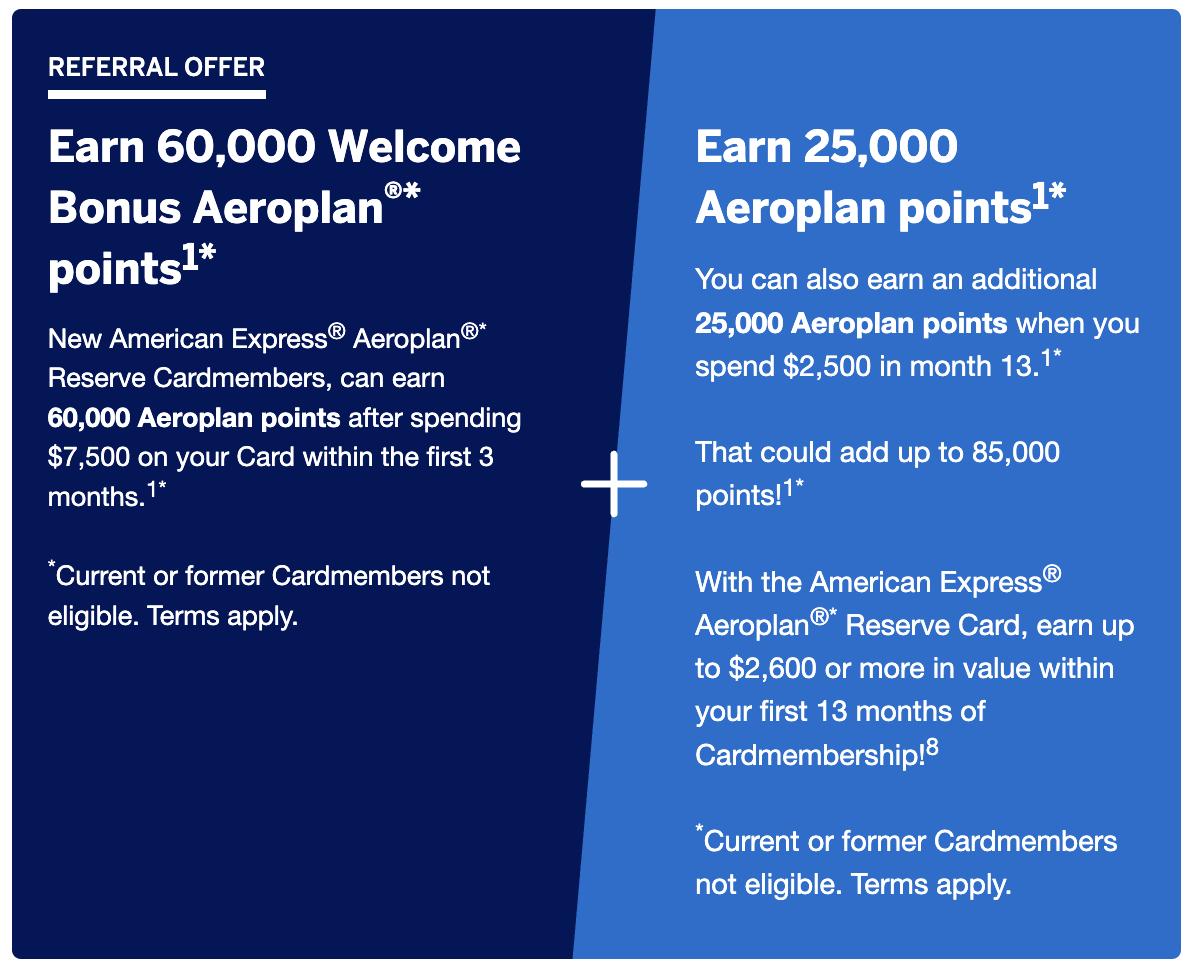

American Express Aeroplan Reserve Card: 85,000 Aeroplan Points

The American Express Aeroplan Reserve Card, Amex’s flagship premium Aeroplan co-branded card, comes with a welcome bonus of up to 85,000 Aeroplan points.

With the current offer, the points are distributed as follows:

- Earn 60,000 Aeroplan points upon spending $7,500 in the first three months

- Earn 25,000 Aeroplan points upon spending $2,500 in month 13 as a cardholder

At Prince of Travel, our favourite tool to pair with minimum spending requirements is Chexy, a Canadian platform that allows you to pay a host of bills – including rent, tuition, utility bills, car lease payments, property taxes, and much more – with a credit card and earn points.

There’s a 1.75% processing fee for each payment (which can be further reduced by referring friends to Chexy), but when you consider the value of the points you earn from spending and welcome bonuses, it’s easy to justify.

The card has an annual fee of $599, and it comes with a number of other perks, including SQM rollover benefits, an extra year of eUpgrade validity, the Annual Worldwide Companion Pass, preferred pricing discounts on Aeroplan redemptions, strong insurance, and some compelling Amex Offers throughout the year to further offset against your annual fee.

Note that the SQM rollover benefits are changing in 2026, as Air Canada moves to a revenue-based earning format for Elite status. Read about all of the changes in our comprehensive coverage.

In terms of the returns on everyday spending, the American Express Aeroplan Reserve Card offers the following three-tiered structure:

- 3 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 2 Aeroplan points per dollar spent on dining and food delivery

- 1.25 Aeroplan points per dollar spent on everything else

It’s worth noting that the 3x earning rate on Air Canada purchases is the highest amongst Canadian Aeroplan co-branded credit cards. If you’re a frequent flyer, this is the best card to use for buying Air Canada flights.

Unlike other Aeroplan premium cards, there’s no minimum income requirement to be eligible to apply.

American Express Aeroplan Reserve Card

- Earn 60,000 Aeroplan points upon spending $7,500 in the first three months

- Plus, earn 25,000 Aeroplan points upon spending $2,500 in month 13 as a cardholder

- Always earn 3x Aeroplan points on Air Canada purchases and 2x Aeroplan points on dining and food delivery

- And, earn 1.25x Aeroplan points on all other eligible purchases

- Aeroplan preferred pricing, free first checked bag, priority check-in and boarding on Air Canada flights

- Unlimited Air Canada Maple Leaf Lounge access in North America

- Bonus Aeroplan points for referring family and friends

- Get an Air Canada Annual Worldwide Pass upon spending $25,000 each year

- No minimum income requirement

- Annual fee: $599

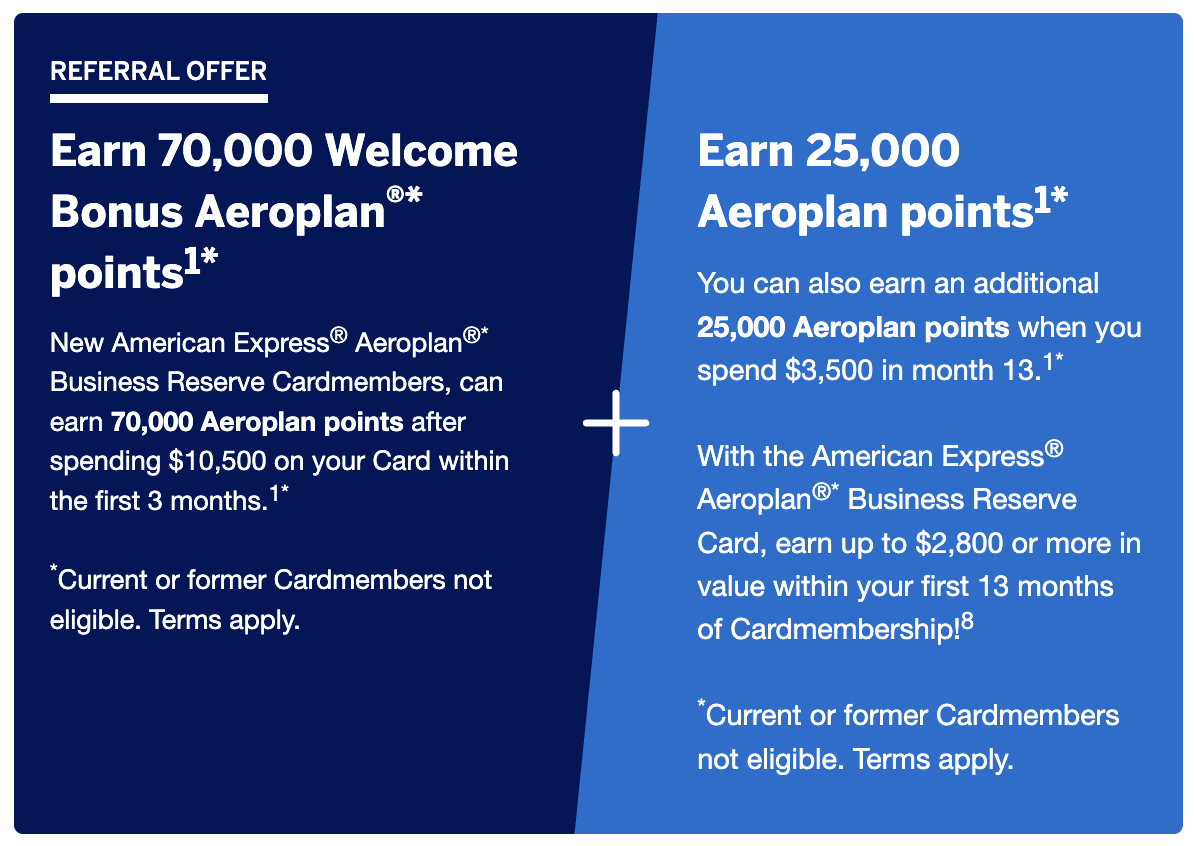

Amex Aeroplan Business Reserve Card: 95,000 Aeroplan Points

The American Express Aeroplan Business Reserve Card is offering a higher number of points than its personal counterpart, albeit paired with higher spending requirements.

When you apply for the card, you can earn up to 95,000 Aeroplan points, structured as follows:

- Earn 70,000 Aeroplan points upon spending $10,500 in the first three months

- Earn 25,000 Aeroplan points upon spending $3,500 in month 13 as a cardholder

If you’re looking to maximize your rewards, you should know that Chexy recently launched a new small business offering, which allows you to pay virtually any business expense with a credit card. And for a limited time, you can earn up to 100,000 Aeroplan® points* in just 3 months.

The card comes with many of the same benefits and features as the Amex Reserve card, including the ability to earn 1,000 Status Qualifying Miles (SQM) and 1 Status Qualifying Segment (SQS) per $5,000 spent on the card.

If you tend to have a high volume of spending, you can easily fast track your way to meeting some of the requirements for Aeroplan Elite Status, and then you can plan out your paid flights to satisfy the Status Qualifying Dollars (SQD) requirement in a more predictable manner.

Plus, the SQM that you earn count towards Threshold Rewards, which can offer lucrative benefits to Air Canada frequent flyers (including the ability to earn a banked year of top-tier Super Elite status and more).

In terms of the returns on everyday spending, the American Express Aeroplan Business Reserve Card offers the following three-tiered structure:

- 3 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 2 Aeroplan points per dollar spent on hotels and car rentals

- 1.25 Aeroplan points per dollar spent on everything else

There’s no listed expiry date on this offer.

American Express Aeroplan Business Reserve Card

- Earn 70,000 Aeroplan points upon spending $10,500 in the first three months

- And, earn 25,000 Aeroplan points upon spending $3,500 in month 13 as a cardholder

- Also, earn 3x Aeroplan points on Air Canada purchases and 2x Aeroplan points on hotels and car rentals

- Plus, earn 1.25x Aeroplan points on all other eligible purchases

- Aeroplan preferred pricing, free first checked bag, priority check-in and boarding on Air Canada flights

- Unlimited Air Canada Maple Leaf Lounge access in North America

- Bonus Aeroplan points for referring family and friends

- Get an Air Canada Annual Worldwide Pass upon spending $25,000 each year

- Qualify for the card as a sole proprietor

- Annual fee: $599

American Express Aeroplan Card: 40,000 Aeroplan Points

While the premium Aeroplan cards naturally have the highest available bonuses, the American Express Aeroplan Card shouldn’t be overlooked.

Currently, the card is offering up to 40,000 Aeroplan points for new applicants, which could be a less expensive way to pad your Aeroplan balance than premium cards, since it doesn’t come with a hefty annual fee.

When you apply for the card, you’ll eligible to earn the following:

- 30,000 Aeroplan points upon spending $3,000 in the first three months as a cardholder

- 10,000 Aeroplan points upon spending $1,000 in month 13 as a cardholder

Indeed, the appeal of the Amex Aeroplan Card is the lower annual fee, making this offer a solid choice for anyone whose credit card strategy revolves around keeping annual fees low and manageable.

Furthermore, the Amex Aeroplan Card is a charge card, not a credit card. Unlike the Reserve and Business Reserve, which are credit cards, it doesn’t impact Amex’s limit of holding four credit cards per person at a time.

If you’re already tight against the cap, the core Aeroplan Card might be a great way to pad your Aeroplan balance without going over your limit.

There’s no listed expiry date for this offer, so be sure to take advantage of it sooner rather than later if it makes sense for you.

American Express Aeroplan Card

- Earn 30,000 Aeroplan points upon spending $3,000 in the first three months

- Plus, earn an additional 10,000 Aeroplan points when you spend $1,000 in month 13

- Always earn 2x Aeroplan points on Air Canada purchases

- Aeroplan preferred pricing, free checked bag on Air Canada flights

- Bonus Aeroplan points for referring family and friends

- Annual fee: $120

Conclusion

American Express has new welcome offers out on the American Express Aeroplan Reserve Card and American Express Aeroplan Business Reserve Card, worth up to 85,000 and 95,000 points, respectively.

On the other hand, the American Express Aeroplan Card has a smaller welcome bonus, but it’s paired with a smaller spending requirement and a much lower annual fee.

If you’re interested in any of the American Express Aeroplan co-branded credit cards, click on any of the “Learn More” buttons to read about the offers and features, or “Apply Now” to head straight to the American Express website to apply.

Please visit:

Our Sponsor