The release of the new iPhone 17 lineup is just around the corner, with pre-orders starting on September 12, 2025.

The new iPhones come in four variants: the iPhone 17, iPhone Air, iPhone 17 Pro, and iPhone 17 Pro Max, with prices ranging from $1,129–2,949 (all figures in CAD).

If you’re planning to get one, you’ve got an opportunity to earn some great rewards by using the right credit card. Plus, depending on which card you use, you may also be able to get insurance coverage for your iPhone at no additional cost.

In this article, let’s take a look at how you can leverage your credit cards to maximize your rewards and insurance benefits for your iPhone purchase.

Buying an iPhone 17 Outright

Rather than queuing outside an Apple Store, the easiest way to buy an iPhone is online. By buying online, you may also be able to use a shopping portal to earn additional rewards on top of what you’ll earn with your credit card.

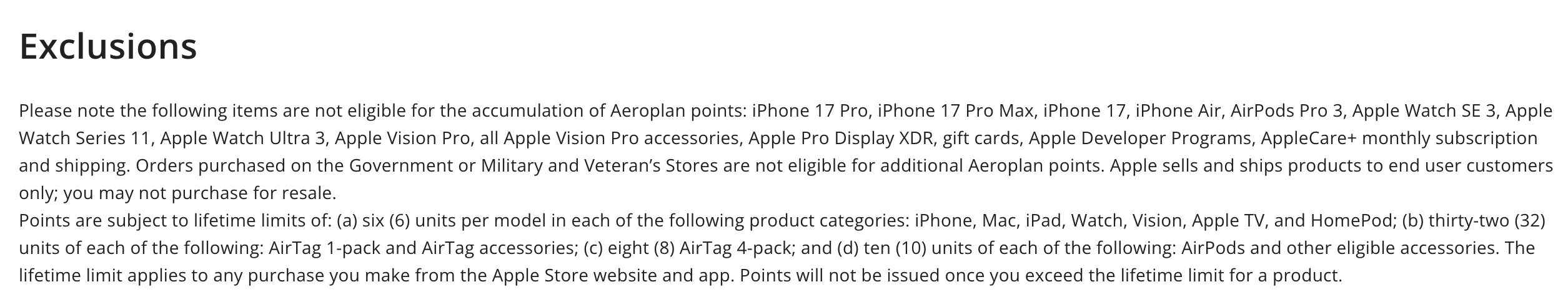

However, new iPhones purchased during launch are often excluded, so be sure to carefully read the terms and conditions on each shopping portal:

At the time of writing, the WestJet Rewards eStore doesn’t mention anything about iPhone 17 exclusions. That said, always double-check the terms on launch day if you plan to purchase via a portal.

If you don’t need the newest iPhone and opt for the iPhone 16 instead, portals like Aeroplan eStore can still earn you bonus rewards, especially during bonus events that go as high as 10x.

The rewards you’ll earn through the online shopping portals are on top of what you’ll earn with your credit card; therefore, you should also strategize which card you’ll use for the purchase so that you can maximize the rewards you get.

Since the iPhone is a relatively large purchase, it could be quite useful in helping you meet a large minimum spending requirement for a credit card welcome bonus.

If you’re in the market for a new credit card, you can get a run down of the welcome bonuses you can work on in our post on the best credit card offers for the month.

You could also strategize by choosing a card that lets you earn the best rewards. Generally speaking, electronics earn a card’s base-rate rewards (like most other retail categories); thus, you should choose a card that has a good baseline earning rate for general purchases.

For example, the TD® Aeroplan® Visa Infinite Privilege* Card earns 1.25 Aeroplan points per dollar spent on retail purchases. Alternatively, consider the Business Platinum Card from American Express, which earns 1.25 Membership Rewards points per dollar spent, or the RBC® Avion Visa Infinite Privilege†, which earns 1.25 Avion points per dollar spent.

iPhone pre-order starts on September 12, 2025 in Canada

iPhone pre-order starts on September 12, 2025 in Canada

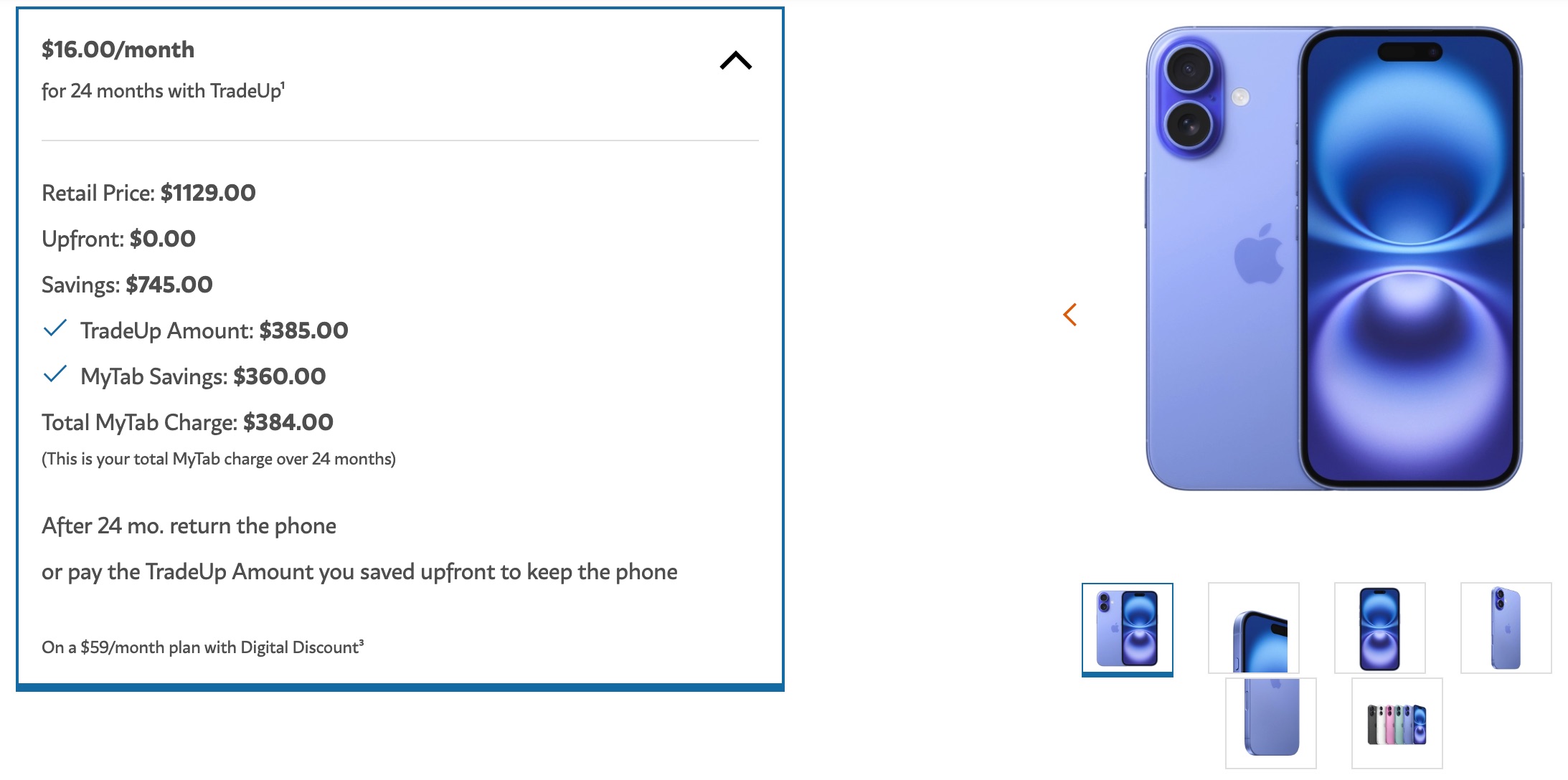

Buying an iPhone 17 as Part of a Phone Plan

Canadian carriers will all soon offer iPhone plans in lockstep fashion. In terms of offers for the general public, they’ll try to match what each carrier is doing; however, if you’ve already been with a carrier for a long time, you might qualify for a retention offer that you can leverage around the new iPhone.

The best way to go about setting up a good phone plan for the iPhone 17 is to ask your current provider for the best deal they can provide you, and then ask the competing providers what they can offer, citing what was offered by your current provider.

An iPhone plan, like other phone plans, is structured such that the rebated cost of the phone is broken down into monthly installments, which you pay alongside the monthly service cost.

Since your payments will be billed monthly, you won’t have a lump-sum charge to your credit card, so the purchase won’t go far to satisfy a minimum spending requirement for a welcome bonus.

However, since your telecom plan is charged as monthly recurring payments, there still are ways to continuously earn valuable rewards.

Several Canadian credit cards offer elevated earning rates on recurring bill payments, such as your phone bill, so there are ways to turn this monthly expense into some decent rewards.

We’ve written a guide to the best credit cards for recurring bill payments, and you can check it out to find the best option for you. For this article, we’ll look at a couple cards from this list that would be good choices to use when buying an iPhone as part of a phone plan.

One strong option is the Scotia Momentum® Visa Infinite Card*, which earns 4% cash back on all recurring bill payments.

It often comes with a welcome bonus of 10% cash back up to a certain amount, and importantly, it includes mobile device insurance—perfect for protecting a pricey new iPhone.

Scotia Momentum® Visa Infinite* Card

- Earn 10% cash back in the first three months, up to $200 total cash back for spending $2,000

- Plus, earn 4% cash back on groceries and recurring bill payments

- Also, earn 2% cash back on gas and transit

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120 (waived for the first year)

Another card worth considering is the Rogers Red World Elite® Mastercard®. This no-fee card earns 2% cash back on all purchases, including recurring bill payments, if you’re a Rogers, Fido, or Shaw customer.

It also offers 50% more value when applying rewards to Rogers, Fido, or Shaw purchases.

Rogers Red World Elite® Mastercard®

- Earn unlimited 3% cash back on U.S. dollar purchases.†

- Earn unlimited 2% cash back on eligible non U.S. dollar purchases–exclusively for eligible Rogers, Fido or Shaw customers.†

- Non-customers earn unlimited 1.5% cash back on eligible non U.S. dollar purchases.†

- Plus, earn 50% more cash back every time you redeem for Rogers, Fido or Shaw purchases.†

- Minimum income: $80,000 personal or $150,000 household

- Annual fee: $0

As a cardholder, you can also purchase a new phone through the Equal Payment Plan at 0% interest, making it a practical choice if you’re already in the Rogers ecosystem.

Credit Card Insurance Benefits Applicable to a New iPhone

Using the right credit card to buy your new iPhone not only lets you earn rewards and savings, but you could also enjoy free insurance coverage that can provide some peace of mind.

Given its hefty price tag, make sure your iPhone is insured

Given its hefty price tag, make sure your iPhone is insured

There are three relevant insurance benefits that may come with your credit card: mobile device insurance, purchase security, and extended protection/warranty.

Mobile Device Insurance

This is the most relevant type of coverage for iPhones, since it protects against accidental damage (think cracked screens or water damage) and mechanical breakdowns.

Usual policies read as follows:

If a mobile device is lost, stolen or suffers a mechanical breakdown or accidental damage, the insurer will reimburse you the lesser of its repair or replacement cost, not exceeding the depreciated value of your mobile device at date of loss, less the deductible, to a maximum of $1,000.

Most other cards offering mobile device insurance only cover up to $1,000, but there are two standout cards that go over this limit:

- Air France KLM World Elite Mastercard® (issued by Brim) – Offers up to $1,500 in coverage, one of the most generous benefits in Canada. It even applies partial coverage if you only pay part of the phone’s cost with the card. If you already hold this card, it’s the one to use.

- RBC® Avion Visa Infinite† – Also covers up to $1,500 for mobile devices. While it doesn’t allow partial-pay protection, it’s backed by RBC’s support network, which some may find more reliable than Brim’s customer service.

Credit Cards with Up to $1,500 Mobile Device Insurance

Purchase Security Insurance

Typical credit card purchase security insurance wording is as follows:

Purchase security coverage automatically, and without registration, protects most new insured items purchased anywhere in the world for 90 days from the date of purchase in the event of loss, theft, or damage in excess of other insurance, provided the full purchase price is charged to the account.

If an insured item is lost, stolen or damaged, you will be reimbursed the lesser of the repair or replacement cost, not exceeding the original purchase price charged to the account.

The detail that needs to be emphasized from the above is that you must charge the entire lump-sum cost of the phone to the card in order to receive purchase security coverage. Thus, this benefit won’t apply if you buy the iPhone as part of a phone plan since you’ll be breaking its cost into monthly installments rather than paying for it all at once.

That said, there are cards that do provide this coverage even when you’ve only paid a portion of the iPhone with the card. One such card is the Air France KLM World Elite Mastercard® – though if the phone gets lost or stolen, you’ll only be reimbursed for the portion paid for with the card.

Purchase security insurance is a feature of most credit cards, even lower-tier cards; however, policies vary by maximum liability limit, so in choosing which card to use for your iPhone, make sure to read the details of its insurance policy.

Extended Warranty

Extended warranty benefits usually read as follows:

Extended warranty coverage provides the cardmember with double the period of repair services otherwise provided by the original manufacturer’s warranty, to a maximum of 1 additional year, on most insured items purchased anywhere in the world when the full purchase price is charged to the account.

Extended warranty benefits are limited to the lesser of the repair cost and the original purchase price charged to the account.

iPhones come with a one-year limited warranty from Apple, and your card’s extended warranty benefit will double that.

However, Apple’s limited warranty only covers inherent defects with the product and not accidental damage, such as cracked screens. Therefore, you might also need extended warranty protection, such as AppleCare+ or a similar service offered by your mobile provider.

Extended warranty can still be useful, but for true device protection, mobile device insurance is far more practical.

Conclusion

Buying an iPhone 17 is a big expense, but the right credit card can help you earn rewards and get useful protections.

Whether you buy outright or through a phone plan, you can maximize your return with points, cash back, or insurance benefits.

The key is to align your iPhone purchase with a card strategy that fits your goals, whether that’s hitting a welcome bonus, earning elevated rewards, or ensuring your device is protected.

Enjoy your iPhone 17!

Please visit:

Our Sponsor